What actually happens after you go in contract on a property isn’t typically foremost on home buyers’ minds—until you land in contract, and your world starts spinning.

The first week to ten days after “ratification” (seller accepting your offer) require a juggling act. Here are the five things you should be prepared to do:

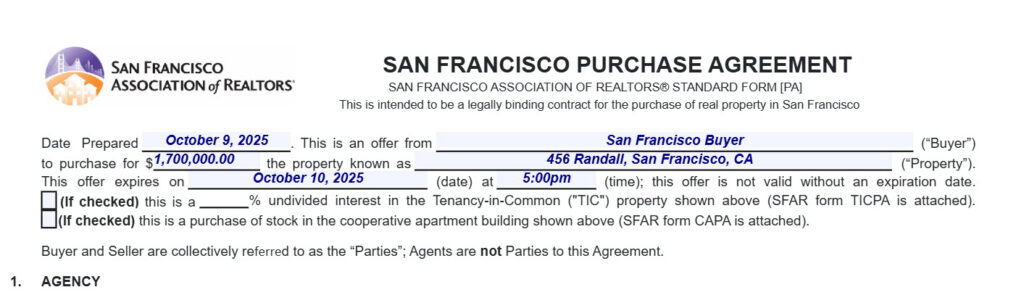

1. Wire your deposit into the escrow account. You’ll need to wire in your good faith deposit (typically 3% of the purchase price) within two days of offer acceptance. First, obtain wiring instructions from the title company. Then call the title company to verify the instructions. Once you’ve done that, call your bank to initiate the wire. (You can alternatively drop a check off at the title company office.) Pro tip: Do not try to initiate the wire on your bank’s Web site. You may unknowingly arrange to send the money via an ACH transfer, and title companies don’t accept those. There also may be limits to how much you can wire in one shot.

2. Submit outstanding financial documentation to your lender. Your lender will invariably need updated financial documentation in order to approve your loan package. If you’re working within a short loan contingency timeframe, you’ll want to deliver those docs to the lender within a day or so of the request. If you’re deciding among multiple lenders, make your final decision within a day or two to avoid delays.

3. Conduct your inspections. Your agent should schedule inspections within the first day of offer acceptance. This will require some flexibility and probably time away from work during the week. Once you have the inspections and review written reports, you’ll be asked to address the contingency—either by removing it, or negotiating any repairs or credits—as per your contractual deadline.

4. Sign outstanding disclosures. You may have signed a bulk of seller disclosures and reports up front, but there will be more. Be sure you set time aside to review what comes in.

5. Address your contingencies. Make sure you’re aware of your deadlines and can respond to any remaining conditions (loan, appraisal, inspection, insurance, statutory disclosures). You’ll have to ultimately sign and submit contingency removal forms to the seller to officially clear your contractual conditions. Your Realtor should be managing the process, so it shouldn’t be all up to you to know when to deal with the individual milestones.